- MerlinsNotes

- Posts

- 9 things we learned at S&P Global's Interact event

9 things we learned at S&P Global's Interact event

ALSO: Spotlight on EQT's Motherbrain

Welcome to a special edition of MerlinsNotes!

Here’s what’s on the desk this week:

9 things we learned from S&P Global’s Interact event in NYC, 3 key insights from real-world research on AI usage

AI supercharges how EQT sources deals

NotebookLM turns your documents into podcasts

Let’s get into it.

FIRST PASS

9 things we learned at S&P Global's Interact event in NYC

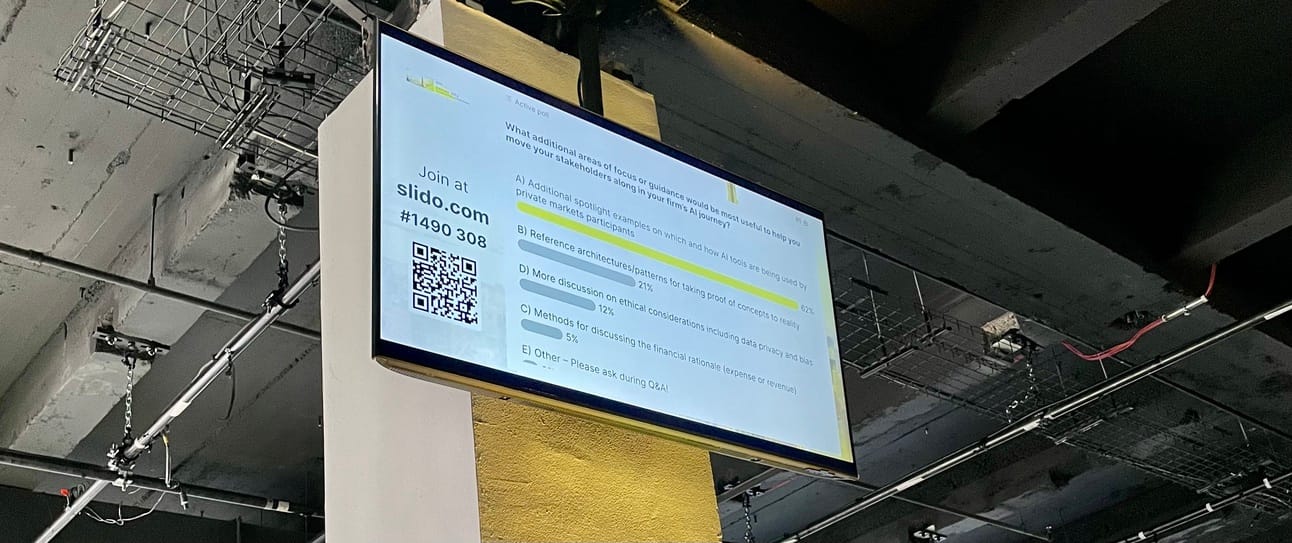

Shane Monastero & I spent a couple of days at S&P Global's Interact event in NYC earlier this week and had a blast!

The event spotlighted private markets and public markets, focusing on strategies for scaling up and maximizing operational alpha, the growth of private credit, AI, and streamlining investment operations, among other topics.

As expected, AI was a hot topic, so I wanted to share 9 things we learned:

1. Education is Critical for AI Adoption

Dr. Tasitsiomi (Head of AI & Data Science @T. Rowe Price) drove home the point that confusion is the biggest barrier to AI adoption.

Other panelists echoed this and stressed the importance of education in overcoming the confusion. To speed up adoption, enterprises should:

Invest in employee training programs

Provide controlled access to AI technologies

Encourage problem-solving with AI tools

Michael Demissie (Head of Applied AI & Practice @BNY) highlighted the enormous potential returns on these educational investments by talking about what BNY was doing, and Dr. Tasitsiomi made a great point about how the benefits of adoption can be amplified depending on which roles are impacted.

2. Balance Automation with Oversight

Harry Mendell (AI Architect @Federal Reserve Bank of New York) cautioned against an over-reliance on technology and made a solid argument for why he thinks there shouldn’t be automation for critical functions.

He provided some great anecdotes and the takeaways were:

Avoid automating critical functions without proper regulation

Maintain fundamental skills alongside technological advancements

Consider the broader societal impact of automation decisions

3. The GenAI Hype is Justified

One thing was abundantly clear throughout the conference: the excitement surrounding GenAI is warranted, mainly due to its ability to handle unstructured data (think PDFs, images, audio etc) more efficiently.

Here were some notable points:

GenAI is the best thing to happen to predictive analytics because of how it exposes weaknesses in legacy systems (Ben Ellencweig, Senior Partner and Global Leader @QuantumBlack, AI by McKinsey)

GenAI improves parsing of information locked in various formats and can lead to meaningful productivity gains through better semantic search (Harry Mendell)

My main learning and recommendation here for folks who have somehow avoided GenAI is to:

Start small to build organizational muscle and follow the 'crawl, walk, run' framework.

4. Good, Standardized Data is Foundational

My favorite line came from Basant Nanda (Global Head of Asset Management Technology, Ameriprise Financial Services, LLC): "Analytics generate alpha, alpha generates revenue."

While it was said in the context of transforming investment operations, it succinctly underscored one of the most prevalent themes of the conference, namely the supreme importance of data and analytics in driving returns.

Given that everyone now realizes the value of data for AI applications, some panelists advised:

Focussing on data governance, quality, and standardization

Prioritizing infrastructure decisions alongside data decisions (Tereza Nemessanyi, Director, VC & PE @Microsoft)

Building a talent Center of Excellence to help portcos reap massive value from AI (Bill Murphy, MD @Cresting Wave)

5. Return to Fundamentals for Successful AI Implementation

Despite the rapid advancement of GenAI, the consensus is that it’s still early days. That said, panelists indicated that the organizations that see success with the tech:

Focus on the business case for AI use (Michael Demissie)

Reverse engineer their desired outcomes before selecting technology (Rinesh Patel, Global Head of Industry, Financial Services @Snowflake)

Take their operating model into account (Ben Ellencweig)

Move from PoCs to production by addressing the technical challenges involved with accuracy & latency (Ruben Falk)

6. AI is Transforming Due Diligence at Scale

One of the most exciting applications of AI in finance is its impact on due diligence and deal-making processes. Multiple speakers highlighted how AI is revolutionizing these areas:

Brett Hickey (CEO @Star Mountain Capital) shared how they built a tool that standardizes deal review and shaves 20-30 hours of analyst time.

Sharad Dutta (CTO @Carlyle) emphasized that diligence is their biggest use case for AI, noting that document-centric workflows will benefit the most from GenAI.

Ruben Falk (Head of Capital Markets @AWS) mentioned Bridgewater’s work in building an AI agent that they believe is on par with a first-year analyst

This is why we started MerlinsNotes!

7. Data & Analytics Drive Successful Portfolio Management

Several speakers shared how they use data & analytics to transform the way they manage investments and portfolios:

Stuart Mayer (Partner @Insight) now collects 50-100 data attributes from portfolio companies using S&P’s iLEVEL platform and uses insights from their large portfolio to help win new deals

Alex Stewart (Principal @WestCap) uses data-driven insights to create concrete case studies for LPs about how they drive growth for their portcos.

8. Ethical Considerations & Trust-building are Imperative

As AI becomes more prevalent, speakers emphasized the need for responsible implementation:

Harry Mendell expressed concerns about using AI in hiring and financing decisions, emphasizing the need for controlled environments.

Ruben Falk noted that trust will improve as enterprises design end-to-end systems that produce more reliable experiences.

Dr. Tasitsiomi highlighted the importance of thinking about how AI will benefit different roles to understand where it can have unexpected value.

9. Data Strategy Remains a Significant Challenge

There was no shortage of talk about data and the challenges associated with readying it for use in a GenAI world.

Indeed, the rapid advancement of AI has painfully revealed the gaps that many organizations (especially large enterprises) have in their data strategy.

Sharad Dutta emphasized that data standardization is still a big problem for them, even with big vendors involved.

Brett Hickey mentioned having 20 people in India just dedicated to cleaning their data to ensure data integrity.

Bill Murphy talked about the challenges of centralizing and normalizing data to make it usable.

HIGHLIGHT

3 Key Insights from Real-World Research on AI Usage (Microsoft)

Microsoft recently conducted one of the largest studies on AI usage in the workplace, analyzing data from 6,317 employees across 58 companies using Microsoft 365 Copilot.

The study reveals fascinating insights into how AI is changing work patterns:

AI is Liberating People from Email Overload

At a consumer goods company, Copilot users spent 31% less time reading emails (50 minutes saved per week).

A telecom company saw a 23% reduction in email reading time (40 minutes saved per week).

An insurance company observed a 21% decrease in individual emails read.

Meetings are Becoming More Value-Focused

A consulting firm's employees spent 16% less time in meetings.

An energy company saw a 12% increase in people leaving meetings early, suggesting comfort in using AI to catch up on missed information.

Teams are using AI to transform meetings into collaborative writing sessions, significantly reducing back-and-forth communication.

AI is Boosting Content Creation and Collaboration

Word document creation increased by 58% at a law firm and 45% at a telecom company.

A financial services company saw Copilot users co-editing 33% more documents.

A national postal service experienced an 82% increase in document commenting for high Copilot users.

A multinational retailer observed a 19% increase in collaborators per user.

Although likely biased in favor of Microsoft, the study nonetheless highlights some compelling data on AI's potential to transform workplace productivity.

JARGON BUSTER

AI Copilot: An AI-powered assistant integrated into software applications to enhance user productivity and creativity. It works alongside humans, offering suggestions, automating tasks, and providing context-aware assistance.

Think of it as a highly intelligent, always-available assistant that complements your expertise, helping you work more efficiently and make more informed decisions.

USE CASE SPOTLIGHT

EQT’s Motherbrain: Leveraging Big Data and ML to gain an edge in investment decision-making

Source: EQT

The Challenge

In the fast-paced world of private equity and venture capital, identifying promising investment opportunities among thousands of startups is like finding a needle in a haystack.

EQT, a global investment firm based in Stockholm, recognized this challenge and sought to leverage AI to gain a competitive edge.

The Solution: Motherbrain

In 2016, EQT launched Motherbrain, an AI-powered platform designed to transform the firm's approach to deal sourcing and investment decision-making.

Built on Google Cloud Platform, Motherbrain has evolved into a sophisticated AI engine that processes vast amounts of data to identify potential investments and support deal-making across EQT's various business lines.

Key Features

Data Integration: Motherbrain combines data from 50+ third-party feeds and internal sources, including Slack channels and employee calendars, creating a proprietary database with hundreds of millions of data points.

AI-Driven Deal Sourcing: The platform generates lists of promising companies based on specified attributes, helping investors identify opportunities they might have otherwise missed.

Market Analysis and Monitoring: Sophisticated similarity models enable analysis of peers, competitors, and potential add-on acquisitions.

Expert and Talent Sourcing: Motherbrain leverages 140,000+ unique connections uploaded by EQT employees to identify key talent and experts in various fields.

Automated Metric Capture: An innovative note parser automatically extracts crucial metrics from investor interactions, streamlining data collection without changing user behavior.

Impact and Results

Venture Capital Success: Motherbrain has directly sourced at least 15 deals for EQT Ventures, including two companies valued at over $1 billion and one successful acquisition.

Cross-Platform Integration: Initially developed for venture capital, Motherbrain now supports EQT's venture, growth, and private equity business lines, fostering information sharing across teams.

Improved Decision Making: By providing investors with data-driven insights, Motherbrain enables faster and more substantiated investment decisions.

Cultural Shift: The platform has driven a digital transformation within EQT, encouraging a data-driven approach to private equity investing.

The Future with ChatGPT

EQT has integrated ChatGPT capabilities into Motherbrain, further streamlining the interaction between investors and AI. This integration allows deal teams and portcos to query the AI directly, enabling more open-ended questions and reducing the need for intermediation by data scientists.

As Alexandra Lutz, head of Motherbrain, puts it: "We're trying to make cyborgs. We believe very strongly that it's not that algorithms and machines will replace human beings. It's just that human beings with algorithms, we think, will outcompete humans who don't have them."

By combining the power of AI with human expertise, EQT is positioning itself at the forefront of technological innovation in private equity, setting a new standard for data-driven investment strategies in the industry.

TOOL OF THE WEEK

NotebookLM

Source: Google

This is one of those AI tools that seems obvious in hindsight, but is really quite a great application of GenAI. NotebookLM (from Google) has gone viral in recent weeks for its ability to create podcasts based on your documents.

It’s built with Google’s Gemini 1.5 model and promises to revolutionize how we interact with and understand complex information.

Here are the key features:

Multimodal Source Integration: Upload PDFs, websites, YouTube videos, audio files, Google Docs, or Google Slides. NotebookLM processes and summarizes them all.

AI-Powered Insights: The tool becomes a personalized AI expert in your uploaded content, making connections between topics.

Source Transparency: Every response comes with clear citations, showing exact quotes from your sources.

Audio Overviews: Turn your sources into engaging "Deep Dive" discussions with one click.

Privacy-Focused: NotebookLM doesn't use your personal data, uploads, queries, or model responses for training (or so Google claims).

Use Cases

Power Study: Ideal for students and professionals looking to deepen their understanding of complex topics.

Presentation Prep: Creates polished outlines with key talking points and supporting evidence.

Idea Generation: Helps identify trends, generate new product ideas, and uncover hidden opportunities from various inputs.

For investment professionals looking to stay ahead of the curve, it's definitely worth exploring for use cases like enhanced due diligence, trend analysis, and presentation support.

Have a question about AI? Or need help with a specific scenario?

We’ve introduced Ask Merlin to answer all your burning questions!

We’ll read every single question and use it to inform future editions. Submit your question by clicking on the button below.

Until next time! I’d welcome your feedback on today’s edition.

Hit reply to this email or shoot me a note at [email protected]

May the tailwinds be ever in your favor,

— James

P.S. Did someone forward this email to you? If so, you can subscribe here!